|

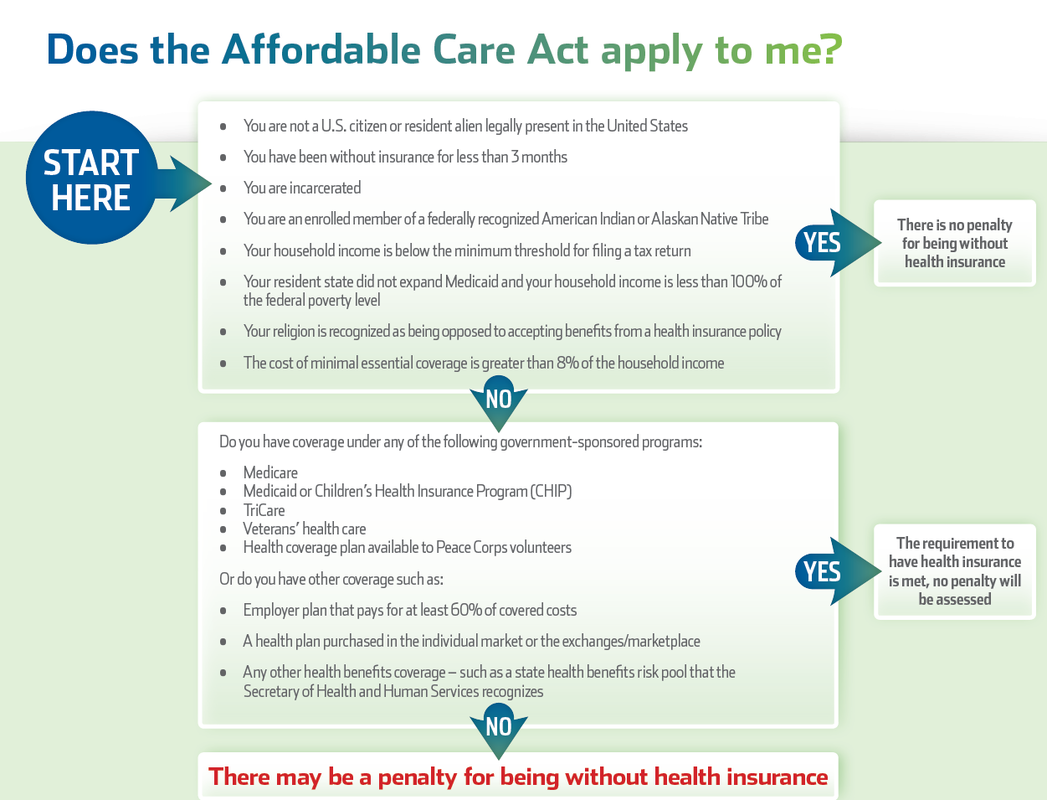

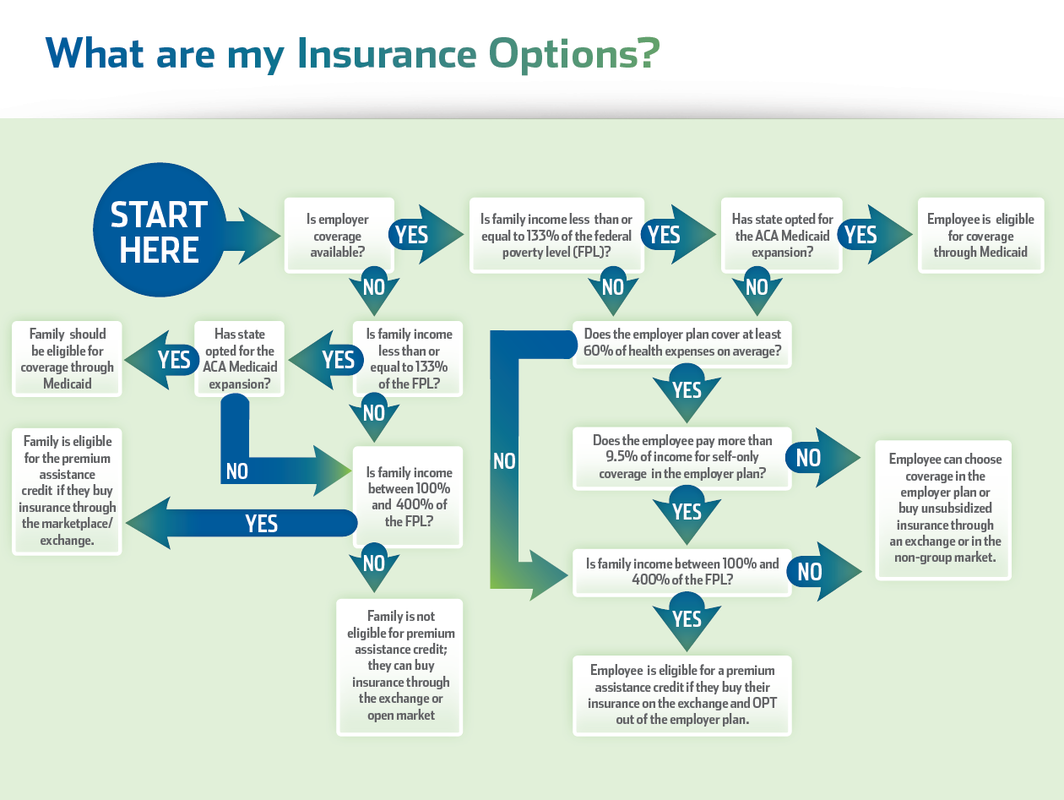

The Affordable Care Act (ACA) requires most Americans to have some form of health insurance or face a tax penalty. It also may provide you and your family with a generous subsidy to purchase health insurance. The law is complex and the impact is far-reaching, but you don’t have to figure it out on your own. We can help. Not only will we help you comply with the law, but we will ensure you receive the most benefits allowed under the law. How?

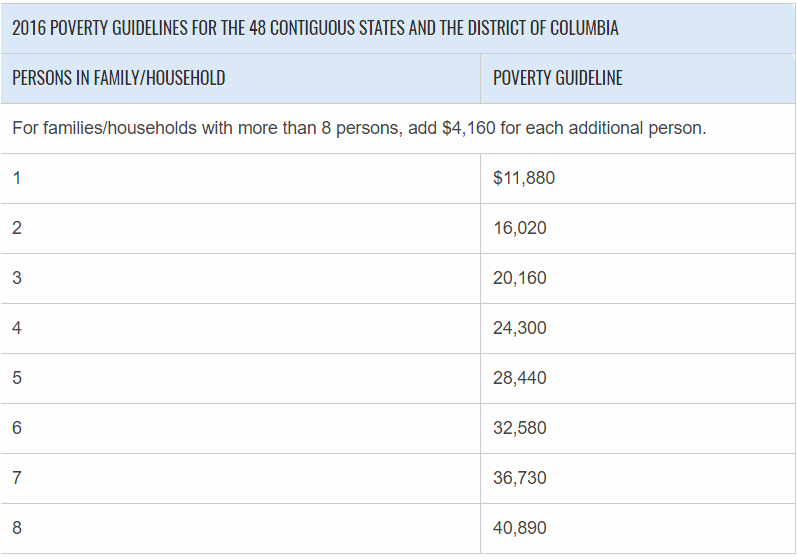

Through our Healthcare Evaluation process, we will: • Estimate your eligibility for the premium assistance credit • Estimate the amount of your premium assistance credit • Show you how the ACA might affect your tax future • Make sure you avoid any tax penalties • Explain the cost-sharing provisions of the ACA, which may reduce your out-of-pocket costs Let us help make sense of the new healthcare mandate. Call us today to set up your Healthcare Evaluation appointment. |

Affordable Care Act Assessment

Use our reliable site to provide you in-depth calculations of the premium assistance credit available to you, as well as list the various health insurance plans available to them within the Exchange and through the private market, and the cost of those plans. Use the following under age 65 or 65 and older links!

|

if you are under age 65Click on the link below you can then select the appropriate qualifying event and then fill out the Exchange application on the eHealth website. You will then be directed to call an eHealth representative to get the ID number to mark the plan as a qualified health plan eligible for a government subsidy.

|

if you are over age 65If you are 65 or better (older) then click on the link below you can then select the appropriate qualifying event and then fill out the Exchange application on the eHealth website. You will then be directed to call an eHealth representative to get the ID number to mark the plan as a qualified health plan eligible for a government subsidy.

|